|

市場調查報告書

商品編碼

1231831

東南亞的保險套產業(2023年~2032年)Research Report on Southeast Asia Condom Industry 2023-2032 |

||||||

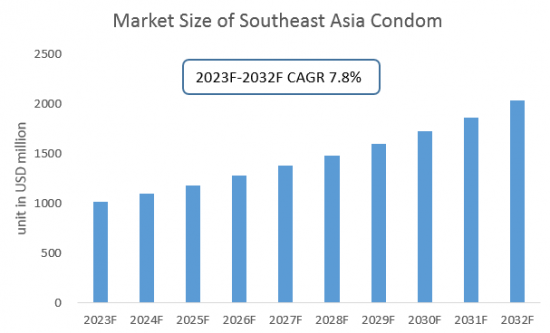

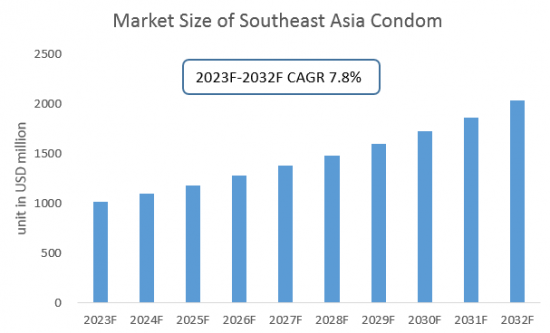

隨著東南亞的經濟發展,因為居民生活水平提高,生育意願下降,促進東南亞的保險套市場發展。

本報告提供東南亞的保險套產業調查分析,主要的促進因素,課題與機會,COVID-19影響等資訊。

樣本圖

目錄

第1章 新加坡的保險套產業的分析

- 新加坡的保險套產業的開發環境

- 地區

- 人口

- 經濟

- 新加坡的最低工資

- 新加坡的保險套產業的經營(2023年~2032年)

- 供給

- 要求

- 進出口情形

- 新加坡的主要的保險套廠商和銷售企業的分析

第2章 泰國的保險套產業的分析

- 泰國的保險套產業的開發環境

- 地區

- 人口

- 經濟

- 泰國的最低工資

- 泰國的保險套產業的經營(2023年~2032年)

- 供給

- 要求

- 進出口情形

- 泰國的主要的保險套廠商和銷售企業的分析

第3章 菲律賓的保險套產業的分析

- 菲律賓的保險套產業的開發環境

- 地區

- 人口

- 經濟

- 菲律賓的最低工資

- 菲律賓的保險套產業的經營(2023年~2032年)

- 供給

- 要求

- 進出口情形

- 菲律賓的主要的保險套廠商和銷售企業的分析

第4章 馬來西亞的保險套產業的分析

- 馬來西亞的保險套產業的開發環境

- 地區

- 人口

- 經濟

- 馬來西亞的最低工資

- 馬來西亞的保險套產業的經營(2023年~2032年)

- 供給

- 要求

- 進出口情形

- 馬來西亞的主要的保險套廠商和銷售企業的分析

第5章 印尼的保險套產業的分析

- 印尼的保險套產業的開發環境

- 地區

- 人口

- 經濟

- 印尼的最低工資

- 印尼的保險套產業的經營(2023年~2032年)

- 供給

- 要求

- 進出口情形

- 印尼的主要的保險套廠商和銷售企業的分析

第6章 越南的保險套產業的分析

- 越南的保險套產業的開發環境

- 地區

- 人口

- 經濟

- 越南的最低工資

- 越南的保險套產業的經營(2023年~2032年)

- 供給

- 要求

- 進出口情形

- 越南的主要的保險套廠商和銷售企業的分析

第7章 緬甸的保險套產業的分析

- 緬甸的保險套產業的開發環境

- 地區

- 人口

- 經濟

- 緬甸的最低工資

- 緬甸的保險套產業的經營(2023年~2032年)

- 供給

- 要求

- 進出口情形

- 緬甸的主要的保險套廠商和銷售企業的分析

第8章 汶萊的保險套產業的分析

- 汶萊的保險套產業的開發環境

- 地區

- 人口

- 經濟

- 汶萊的最低工資

- 汶萊的保險套產業的經營(2023年~2032年)

- 供給

- 要求

- 進出口情形

- 汶萊的主要的保險套廠商和銷售企業的分析

第9章 寮國的保險套產業的分析

- 寮國的保險套產業的開發環境

- 地區

- 人口

- 經濟

- 寮國的最低工資

- 寮國的保險套產業的經營(2023年~2032年)

- 供給

- 要求

- 進出口情形

- 寮國的主要的保險套廠商和銷售企業的分析

第10章 柬埔寨的保險套產業的分析

- 柬埔寨的保險套產業的開發環境

- 地區

- 人口

- 經濟

- 柬埔寨的最低工資

- 柬埔寨的保險套產業的經營(2023年~2032年)

- 供給

- 要求

- 進出口情形

- 柬埔寨的主要的保險套廠商和銷售企業的分析

第11章 東南亞的保險套產業預測(2023年~2032年)

- 東南亞的保險套影響產業的發展要素的分析

- 有利的要素

- 不利的要素

- 東南亞的保險套產業的供給的分析(2023年~2032年)

- 東南亞的保險套產業的需求的分析(2023年~2032年)

- COVID-19流行對保險套產業的影響

Southeast Asia has been the largest producer of natural rubber in the world. According to CRI's analysis, Thailand, Indonesia and Malaysia are the world's major natural rubber producers and exporters, and their combined production accounts for more than half of the global natural rubber, which has long influenced the trend of the international natural rubber market. However, in recent years, the production of natural rubber in Vietnam, the Philippines, Cambodia, Lao and Myanmar has also started to rise.

SAMPLE VIEW

Due to the different industrial bases of Southeast Asian countries, although Southeast Asia is rich in latex, the raw material for condoms, but the level of development of condom industry in Southeast Asian countries varies greatly. According to CRI analysis, Thailand and Malaysia because of the more developed manufacturing industry, so a large number of condoms produced and exported every year. While the rest of Southeast Asian countries, condoms mainly rely on imports.

In Southeast Asia, there are both local condom manufacturers, such as Malaysia's Karex, and foreign companies with condom factories in Southeast Asia. Overall, Southeast Asia is one of the world's major condom producers and exporters.

With the development of Southeast Asia's economy, residents' living standards are rising and their willingness to have children is declining, leading to a declining fertility rate in Southeast Asia, which has promoted the development of Southeast Asia's condom market. According to CRI's analysis, most of the condoms purchased by Southeast Asian residents are locally manufactured products in Southeast Asia, but high-end condom products from Japan and other places also hold a certain market share.

At the same time, Southeast Asia has cheap and abundant labor, lower land costs and favorable policy support, attracting global condom manufacturers to shift production capacity to the Southeast Asian region.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of over 600 million by the end of 2021, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI's analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$73,000 in 2021. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2021. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2021, while Indonesia, which has the largest population, will have a population of about 275 million people in 2021.

CRI expects condom production and exports to continue to rise in Southeast Asia from 2023-2032. Some condom manufacturers from places like China will boost their condom production capacity in Southeast Asia to reduce manufacturing costs.

Topics covered:

- Southeast Asia Condom Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Condom Industry?

- Which Companies are the Major Players in Southeast Asia Condom Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Condom Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Condom Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Condom Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Condom Industry Market?

- Which Segment of Southeast Asia Condom Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Condom Industry?

Table of Contents

1 Singapore Condom Industry Analysis

- 1.1 Singapore Condom Industry Development Environment

- 1.1.1 Geography

- 1.1.2 Population

- 1.1.3 Economy

- 1.1.4 Minimum Wage in Singapore

- 1.2 Singapore Condom Industry Operation 2023-2032

- 1.2.1 Supply

- 1.2.2 Demand

- 1.2.3 Import and Export Status

- 1.3 Analysis of Major Condom Manufacturing and Sales Companies in Singapore

2 Analysis of Thailand Condom Industry

- 2.1 Development Environment of Thailand Condom Industry

- 2.1.1 Geography

- 2.1.2 Population

- 2.1.3 Economy

- 2.1.4 Thailand Minimum Wage

- 2.2 Thailand Condom Industry Operation 2023-2032

- 2.2.1 Supply

- 2.2.2 Demand

- 2.2.3 Import and Export Status

- 2.3 Analysis of Major Condom Manufacturing and Sales Companies in Thailand

3 Analysis of the Philippine Condom Industry

- 3.1 Development Environment of Condom Industry in the Philippines

- 3.1.1 Geography

- 3.1.2 Population

- 3.1.3 Economy

- 3.1.4 Minimum Wage in the Philippines

- 3.2 Philippine Condom Industry Operation 2023-2032

- 3.2.1 Supply

- 3.2.2 Demand

- 3.2.3 Import and Export Situation

- 3.3 Analysis of Major Condom Manufacturing and Sales Companies in the Philippines

4 Malaysia Condom Industry Analysis

- 4.1 Malaysia Condom Industry Development Environment

- 4.1.1 Geography

- 4.1.2 Population

- 4.1.3 Economy

- 4.1.4 Minimum Wage in Malaysia

- 4.2 Malaysia Condom Industry Operation 2023-2032

- 4.2.1 Supply

- 4.2.2 Demand

- 4.2.3 Import and Export Status

- 4.3 Analysis of Major Condom Manufacturing and Sales Companies in Malaysia

5 Indonesia Condom Industry Analysis

- 5.1 Indonesia Condom Industry Development Environment

- 5.1.1 Geography

- 5.1.2 Population

- 5.1.3 Economy

- 5.1.4 Minimum Wage in Indonesia

- 5.2 Indonesia Condom Industry Operation 2023-2032

- 5.2.1 Supply

- 5.2.2 Demand

- 5.2.3 Import and Export Status

- 5.3 Analysis of Major Condom Manufacturing and Sales Companies in Indonesia

6 Analysis of Condom Industry in Vietnam

- 6.1 Development Environment of Condom Industry in Vietnam

- 6.1.1 Geography

- 6.1.2 Population

- 6.1.3 Economy

- 6.1.4 Minimum Wage in Vietnam

- 6.2 Vietnam Condom Industry Operation 2023-2032

- 6.2.1 Supply

- 6.2.2 Demand

- 6.2.3 Import and Export Situation

- 6.3 Analysis of Major Condom Production and Sales Enterprises in Vietnam

7 Analysis of Condom Industry in Myanmar

- 7.1 Development Environment of Condom Industry in Myanmar

- 7.1.1 Geography

- 7.1.2 Population

- 7.1.3 Economy

- 7.1.4 Myanmar Minimum Wage

- 7.2 Myanmar Condom Industry Operation 2023-2032

- 7.2.1 Supply

- 7.2.2 Demand

- 7.2.3 Import and Export Situation

- 7.3 Analysis of Major Condom Production and Sales Companies in Myanmar

8 Analysis of Brunei Condom Industry

- 8.1 Brunei Condom Industry Development Environment

- 8.1.1 Geography

- 8.1.2 Population

- 8.1.3 Economy

- 8.1.4 Brunei Minimum Wage

- 8.2 Brunei Condom Industry Operation 2023-2032

- 8.2.1 Supply

- 8.2.2 Demand

- 8.2.3 Import and Export Status

- 8.3 Analysis of Major Condom Manufacturing and Sales Companies in Brunei

9 Analysis of the Condom Industry in Laos

- 9.1 Development Environment of Condom Industry in Laos

- 9.1.1 Geography

- 9.1.2 Population

- 9.1.3 Economy

- 9.1.4 Minimum Wage in Laos

- 9.2 Operation of the Condom Industry in Laos 2023-2032

- 9.2.1 Supply

- 9.2.2 Demand

- 9.2.3 Import and Export Status

- 9.3 Analysis of Major Condom Production and Sales Companies in Laos

10 Analysis of the Condom Industry in Cambodia

- 10.1 Development Environment of Cambodia Condom Industry

- 10.1.1 Geography

- 10.1.2 Population

- 10.1.3 Economy

- 10.1.4 Minimum Wage in Cambodia

- 10.2 Cambodia Condom Industry Operation in 2023-2032

- 10.2.1 Supply

- 10.2.2 Demand

- 10.2.3 Import and Export Situation

- 10.3 Analysis of Major Condom Manufacturing and Sales Companies in Cambodia

11 Southeast Asia Condom Industry Outlook 2023-2032

- 11.1 Southeast Asia Condom Industry Development Influencing Factors Analysis

- 11.1.1 Favorable Factors

- 11.1.2 Unfavorable Factors

- 11.2 Southeast Asia Condom Industry Supply Analysis 2023-2032

- 11.3 Southeast Asia Condom Industry Demand Analysis 2023-2032

- 11.4 Impact of COVID -19 Epidemic on Condom Industry